tennessee inheritance tax return short form

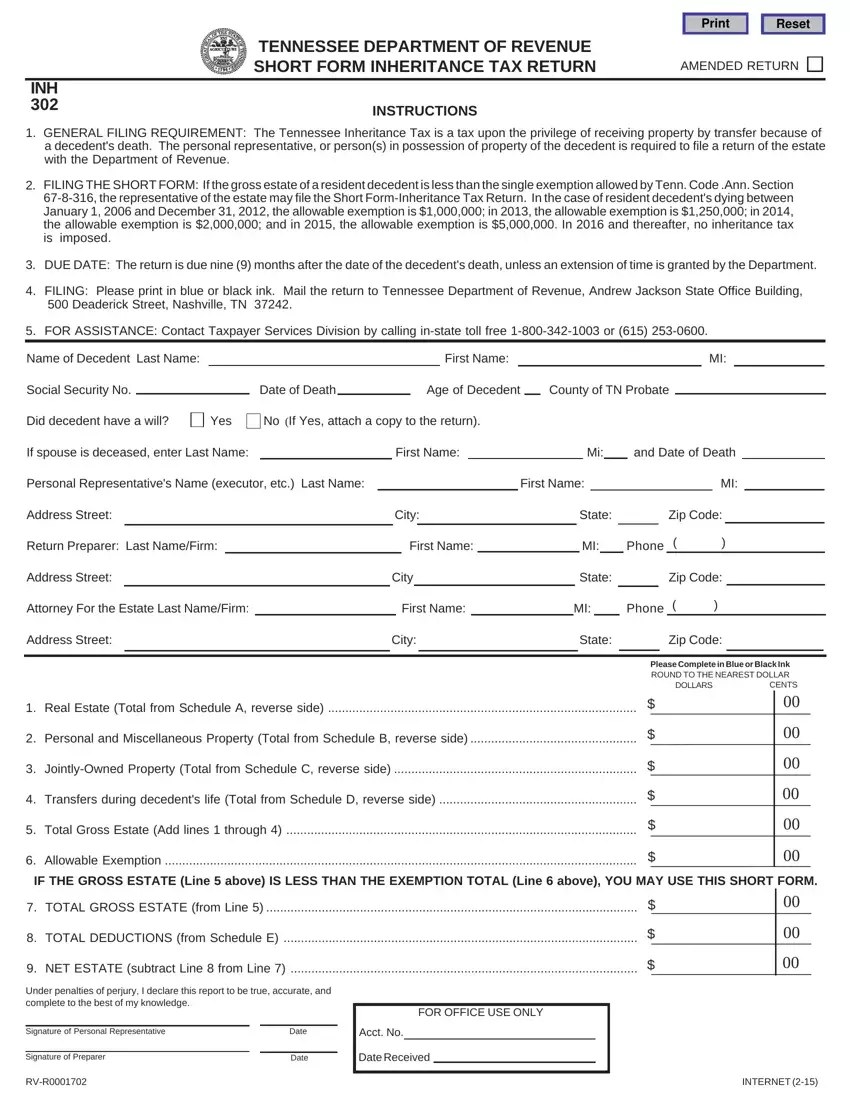

TENNESSEE DEPARTMENT OF REVENUE SHORT FORM INHERITANCE TAX RETURN INH 302 INSTRUCTIONS AMENDED RETURN 1. Print TENNESSEE DEPARTMENT OF REVENUE SHORT FORM INHERITANCE TAX RETURN INH Reset AMENDED RETURN INSTRUCTIONS 1.

Free Termination Letter Template Letter Templates Lettering Introduction Letter

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

. If the gross estate of a resident decedent is less than the single exemption allowed by TCA. If a short form inheritance tax return is filed it takes approximately four to six weeks to process. Section 67-8-316 the representative of the estate may file the.

Experience a faster way to fill out and sign forms on the web. A long form inheritance tax return. Browse By State Alabama AL Alaska AK Arizona AZ.

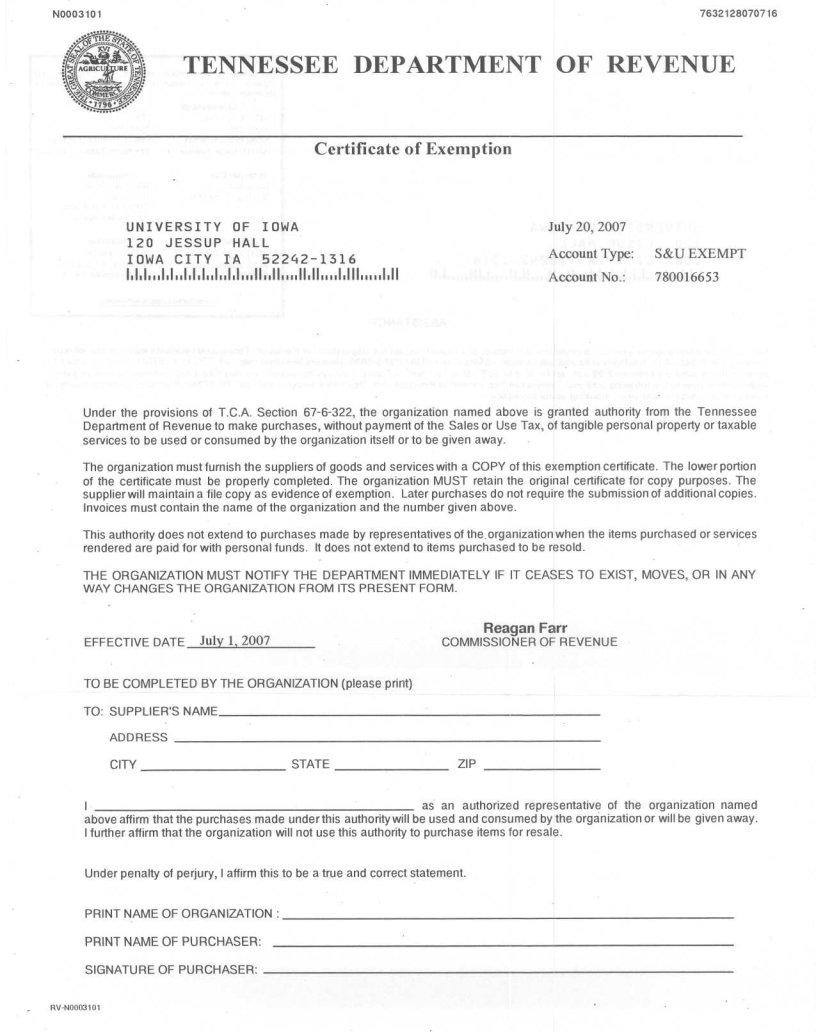

Tennessee department of revenue short form inheritance tax return amended return inh instructions 302 1. Fill-in State Inheritance Tax Return Short Form 1. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. The net estate is the fair market value of all. SHORT FORM INHERITANCE TAX RETURN IF THE GROSS ESTATE Line 5 above IS LESS THAN THE EXEMPTION TOTAL Line 6 above YOU MAY USE THIS SHORT FORM.

In the case of resident decedents dying between January 1 1990 and June 30. Prior to this amendment estates where an individual died before January 1 2014 were exempt from filing a Short Form Inheritance. Citizen or resident and.

Import Your Tax Forms And File For Your Max Refund Today. Download State Inheritance Tax Return Short Form Department of Revenue Tennessee form. A GUIDE TO TENNESSEE INHERITANCE AND ESTATE TAXES Tennessee has two death taxes.

We make completing any Tennessee Inheritance Tax Short Form Extension simpler. Section 67-8-316 the representative of the. Use US Legal Forms to find the Tennessee Estate and Inheritance Tax Return Engagement Letter - 706 in a number of click throughs.

IT-20 - Inheritance Tax - Closure Certificate. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. Section 67-8-316 the representative of the estate may file the Short-Form Inheritance Tax Return.

Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. No Matter What Your Tax Situation Is TurboTax Has Your IRS Taxes Covered. FILING THE SHORT FORM.

This new bill amended TCA. Ad Download Or Email TN INH 302 More Fillable Forms Try for Free Now. Ad Get A Jumpstart On Your Taxes.

If the decedent is a US. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside.

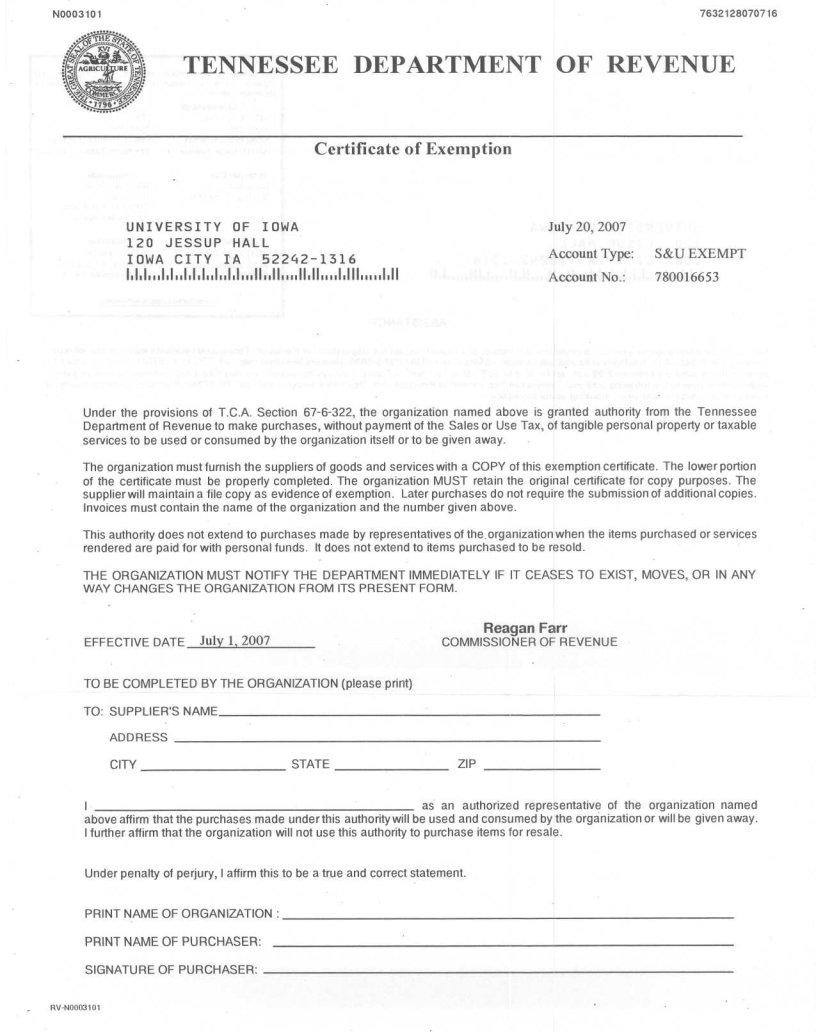

Tennessee Exemption Certificate Fill Out Printable Pdf Forms Online

Form Inheritance Fill Out Printable Pdf Forms Online

Free Printable Checklist For Use By Executor Legal Forms Legal Forms Printable Checklist Checklist

Free Tennessee Tax Power Of Attorney Form Rv F0103801 Pdf Eforms

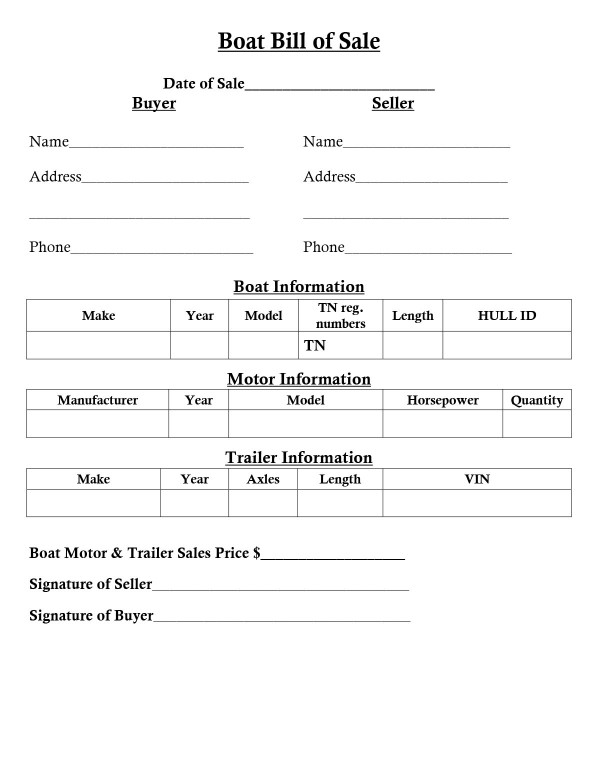

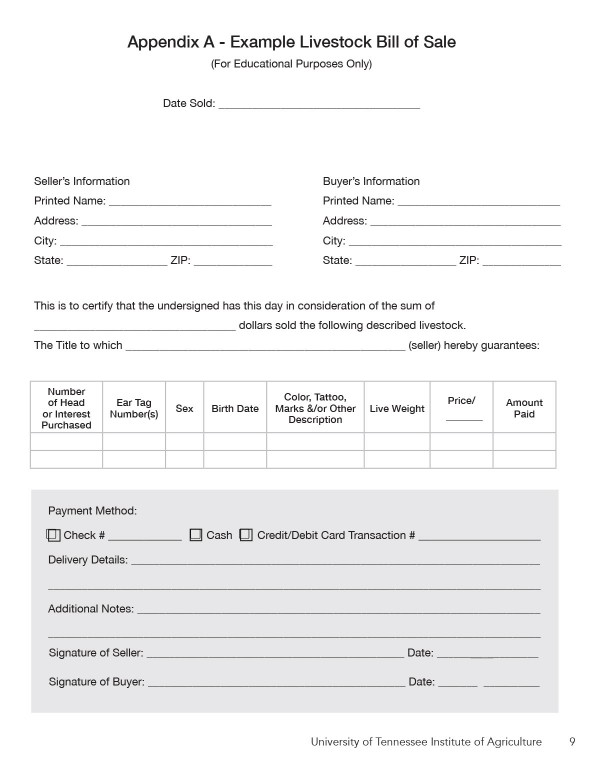

Bills Of Sale In Tennessee The Forms Facts Requirements

Bills Of Sale In Tennessee The Forms Facts Requirements

Tennessee Estate Tax Everything You Need To Know Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Marriage Marriage Certificate Matrimony

Free Tennessee Revocable Living Trust Form Pdf Word Eforms

Free Tennessee Power Of Attorney Forms Pdf Word Downloads

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Mortgage Interest Rates

State Corporate Income Tax Rates And Brackets Tax Foundation

Get And Sign Tennessee Sales Tax Exemption Form 2008 2022

Lease Agreement Form Zimbabwe Pdf Ten Things You Should Know About Lease Agreement Form Zimb Rental Agreement Templates Lease Agreement Contract Template